Turning Two

Following our strategic shift during 2017, we have a portfolio focused on two plays, the Eagle Ford Shale and Delaware Basin, where we currently hold more than 122,000 net acres. And much the way infielders work together to turn a double play, we believe that these assets work together to give us a high chance of success while managing our risk. We have a deep inventory of high-return drilling locations in each play, with more than 700 net derisked locations in the Eagle Ford Shale and more than 400 in the Delaware Basin. While the drilling locations are in two plays, their proximity makes it relatively easy for us to shift activity between them. This allows us to take advantage of market opportunities or manage any potential short-term basin-wide bottlenecks by shifting capital to the basin generating the highest returns.

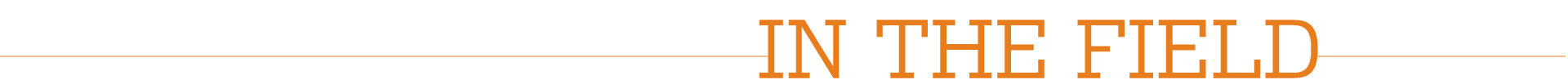

We have been active in the Eagle Ford Shale since 2010, and have drilled more than 400 wells in the play since that time. This has provided us with a substantial amount of data, which we have used to continually optimize our activities. This continued focus on improvement has led to us being one of the most efficient operators in the basin. We currently have two rigs running in the play, and typically drill wells in about 10 days, down about 50% from when we first started operating in the play despite laterals that are 60% longer. Our completions operations also rank us among the most efficient operators in the play. Our dedicated completion crew typically averages about 7 frac stages per day, and consistently ranks as one of the top crews in the pressure pumper’s fleet.

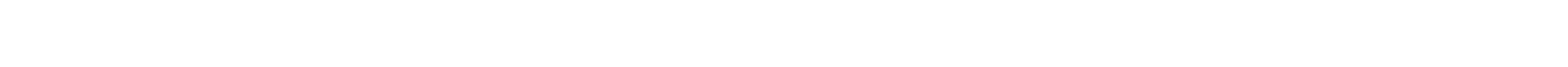

As we ramp up our activity in the Delaware Basin during 2018, we expect to leverage the knowledge we have acquired operating in other plays such as the Eagle Ford Shale. Our operations in the Delaware Basin are still relatively new, so we see significant opportunities to improve our efficiencies over time; this should hopefully result in lower costs and enhanced returns. For example, we are currently drilling wells in the Delaware Basin in 30-45 days and completing 3-4 stages per day. As we move to pad drilling and bring other learnings into the basin, we expect to materially improve upon both of these metrics.

Mickey Vernon was part of more than 2,000 double plays over his 20-year career, the most in baseball history.

Expanding the Zone

One of the things that attracted us to the Delaware Basin was the stacked pay nature of the play. Most oil and gas plays have only one or two zones that could be prospective. But in the Delaware Basin, we see up to 10 potential targets across a 3,800-ft.-thick geologic section stretching from the Avalon Shale down to the Wolfcamp D.

To date, our development activity has focused on the Wolfcamp A as well as the Upper and Lower Wolfcamp B, where we currently have more than 400 net derisked locations in our inventory. This equates to a more than 10-year inventory of drilling locations at our current pace. Over time, our focus is to not only exploit these high-return locations, but also expand the derisked pay zone to include other targets. Assuming this is successful, we have the potential to more than double our inventory of derisked locations on the acreage.

The industry has already begun testing some of these other targets. We currently have a well producing out of the Wolfcamp D on our acreage, and offset production has been established in the Wolfcamp C, Wolfcamp X/Y, and 3rd Bone Spring. While we don’t expect all seven additional targets to be economical across the entirety of our acreage position in the Delaware Basin, the sheer size of the target zone means that the probability of at least one or two additional targets working are in our favor. During 2018, our activity is expected to remain focused on development of the Wolfcamp A and B, though we do plan to drill at least one test of another target later in the year.

Between 2008 and 2016, the downward expansion of the strike zone resulted in more success for pitchers, as strikeout rates increased by more than 20% over the period. (Stark, 2016)

Financial Strategy

While assembling the right portfolio of assets was a key component of our strategic shift, it was not the only part of our plan. We also wanted to ensure that we had an appropriate financial strategy and balance sheet in order to be able to economically develop our assets in any commodity price environment.

Following the ExL acquisition in the Delaware Basin, we elected to further strengthen our balance sheet by monetizing non-core assets and using the proceeds to reduce debt. Our Appalachian asset sales closed in the fourth quarter of 2017, while our DJ Basin and downdip Eagle Ford asset sales closed this January. The proceeds from these deals allowed us to redeem $470 million of our long-term debt as well as $50 million of preferred stock. As a result, our leverage has declined by more than a turn since mid-2017, and our goal is to further reduce it below 2x. We believe this will give us sufficient financial flexibility to manage future volatility in commodity prices.

We seek to protect our cash flows and returns through our hedging activity. For 2018, we currently have hedges covering approximately 75% of estimated crude oil production. We have also placed hedges on more than 50% of our estimated NGL production and approximately 35% of our estimated natural gas production. Based on current oilfield service cost assumptions, these hedges lock in a strong minimum operating margin on a large percentage of our production.

As a result of these moves, we are in a strong position to execute on our corporate goals of generating prudent, economical growth, and being able to consistently deliver this within our cash flow.