THE MAV STORY

PIONEERING MASSTIGE

“Since our beginning in 1995, our mission has been to deliver premium quality products that are accessible to and convenient for consumers.”

Marc Anthony Venere

Founder & CEO

THE MAV STORY

OUR MISION

Our mission is to always meet and exceed our consumers’ expectations by delivering premium-quality products that are accessible and convenient. That simple mission has been at the core of our success. With the acquisitions of Renpure and Cake Beauty, we have broadened and enhanced our core offerings to better serve both our retail partners’ and consumers’ needs. MAV Beauty Brands is now the largest independent collection of personal care brands in Canada and one of the top 10 haircare companies in North America.

THE MAV STORY

BUILDING ICONIC BRANDS

Building on our success with Renpure and Cake Beauty, MAV Beauty Brands aims to strategically acquire complementary iconic brands.

1.

ACQUIRE FAST-GROWING INDEPENDENT BRANDS

Consumers are increasingly choosing independent brands that are perceived to be higher quality, more authentic, on-trend and innovative. That’s our focus.

2.

ENTREPRENEURIAL AND INNOVATION-DRIVEN CULTURE

We believe that the entrepreneurial and innovation-driven culture of MAV Beauty Brands is highly attractive to founders who wish to remain involved in the business post-acquisition.

3.

UNLOCK SALES POTENTIAL THROUGH GLOBAL OPERATING PLATFORM

By leveraging our 100+ retailer relationships and established distribution platform, we can significantly increase the distribution of acquired brands.

4.

OPERATIONAL EFFICIENCIES AND BEST PRACTICES

In addition to the revenue synergies, we leverage an asset-light supply chain to provide our brands with high-quality, low-cost manufacturing and operational

OUR BUSINESS TODAY

THE BRANDS

OUR BUSINESS TODAY

STRONG AND COLLABORATIVE RETAIL AND DISTRIBUTION PARTNERS

Select North American Retail Partners

CVS, Rite-Aid,

Shoppers Drug Mart,

Walgreens, Target,

Walmart, HEB, Kroger,

Loblaws, Costco,

Ulta Beauty

Dollar General, Family Dollar

Burlington,

Ross, Boots UK, TJX

Leading International Distributors

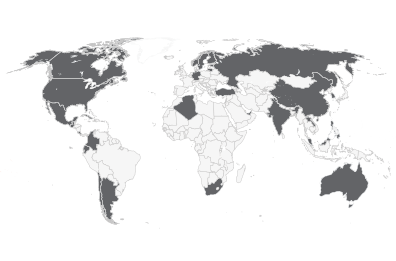

COUNTRIES

100+

RETAILERS

60K+

DOORS

OUR BUSINESS TODAY

WINNING INNOVATION

We believe our agile innovation process is a critical competitive advantage

that underpins our demonstrated ability to win market share.

Product

Ideas

Integrated Product

Development

Consumer and

Retailer Feedback

and Validation

Flexible

Supply Chain

OUR BUSINESS TODAY

SALES & MARKETING

MAV Beauty Brands uses a performance-based and cost-efficient marketing strategy.

We invest &

activate in store

The majority of our marketing investments are spent in store, in partnership with retailers, to drive consumers to the shelf, where purchasing decisions are made. In-store marketing is a cost-efficient strategy that allows us to track and measure our performance in real time.

We use efficient channels

to build community

To complement our in-store marketing, we use other efficient channels, including social media and microinfluencers, to develop authentic consumer connections, generate brand awareness and drive consumer and retailer demand for our products.

OUR BUSINESS TODAY

STRONG HISTORICAL PERFORMANCE

Revenue

(in US$ millions)

17.5%CAGR

Adjusted Gross Profit

(in US$ millions)

12.9%CAGR

Adjusted EBITDA

(in US$ millions)

8%CAGR

THE MAV STORY

OUR MODEL IS WORKING

36%

2018 PRO FORMA REVENUE GROWTH1

14%

POS GROWTH FOR

MAV BEAUTY BRANDS PORTFOLIO2

#1

FASTEST-GROWING BRAND

IN U.S. DRUG CHANNEL

(MARC ANTHONY TRUE PROFESSIONAL)3

1) Pro forma for ownership of Renpure as of January 1, 2017 and includes Cake Beauty as of January 23, 2018.

2) Nielsen AOD, BC SUPER CATEGORY: HAIR CARE – Total US – Q1 (JFM) W/E 03/30/19

3) Nielsen AOD, BC SUPER CATEGORY: HAIR CARE – Total US – OND 18 (W/E 12/29/2018)

WHERE WE ARE GOING

GROWING IN LARGE, STABLE MARKETS

Source: Euromonitor International, Beauty and Personal Care 2019 Edition.

1) As per Euromonitor International’s Baby and Child Specific definitions.

2) As per Euromonitor International’s Skin Care and Bath & Shower definitions.

WHERE WE ARE GOING

MAV BEAUTY BENEFITS FROM 4 KEY TRENDS

Strong consumer demand for higher quality products that are convenient

SHIFTING AWAY FROM SALON PROFESSIONAL & TRADING UP FROM TRADITIONAL MASS

Increasing popularity of authentic, independently-founded brands

+9%

2-YEAR CAGR OF INDEPENDENTLY FOUNDED BRANDS1

Growing demand for natural personal care products

+10%

4-YEAR CAGR OF THE GLOBAL NATURAL AND ORGANIC PERSONAL CARE PRODUCTS MARKET2

Millennials spend disproportionally high amounts on beauty & personal care

+30%

ANTICIPATED INCREASE IN MILLENNIALS’ SHARE OF THE TOTAL U.S. RETAIL EXPENDITURE BY 2020P

3

1) Includes Hask, Marc Anthony, Maui Moisture, Not Your Mother’s, OGX, Renpure and Shea Moisture; U.S. retail sales data per Nielsen (2-year CAGR from Q1 2017 - Q1 2019).

2) Source: Persistence Market Research – Global natural & organic personal care market, 2018 report purchased in April 2018.

3) Source: U.S. Census Bureau and Fung Global Retail & Technology.

WHERE WE ARE GOING

MULTIPLE LEVERS

MAV Beauty Brands has multiple levers to continue to generate strong organic growth.

612

U.S. Distribution Points in Q1 2019, compared to an average of 2,786 for the top 10 U.S. Hair Care Brands1

15X

Increase in Cake Beauty distribution since acquisition

10

New markets in 2018

New body SKUs (wash and lotion) introduced in 2018

1) U.S. Nielsen downloaded May 2019. Based on the Brand High Total Distribution Points (“TDP”) of the Marc Anthony, Renpure and Cake brands for Q1 2019. TDP is an approximate measurement of the distribution of a brand (or ‘‘product aggregate’’) while taking into account the number of retail locations and Universal Product Codes, or UPCs, selling within that brand or aggregate; the calculation is the sum of % ACV across UPCs. The Company believes that this metric provides a relative indication of retail penetration factoring in both distribution breadth and distribution depth.

2) Top 10 hair care brands include L'Oréal, Garnier, TRESemmé, Pantene, Suave, Head & Shoulders, OGX, Dove, Herbal Essences, Aussie.

FELLOW SHAREHOLDERS

I’m pleased to address our shareholders in our first year-end report as a public company. Fiscal 2018 was a transformative year for MAV Beauty Brands. We completed the acquisitions of two high-growth brands, followed by an initial public offering (IPO) – key corporate milestones that accelerated our path to building a global personal care company.

When we went public, we were confident our portfolio of on-trend brands would continue to win shelf space and deliver sales growth well above the industry average (U.S. growth rate of 2.4% in 2018). Our confidence reflects a highly positive industry backdrop, supported by the overall growth in masstige products and increasing demand for authentic, independently founded brands. Our portfolio also gives us exposure to the growth in naturals and millennial spending – two important trends in personal care.

Throughout 2018, we proved that our brands, combined with our global operating platform, can deliver exceptional organic growth. We reported $103 million in pro forma revenue, a 36% increase over 2017 and ahead of our previously raised revenue target of $95 to $100 million. In addition to top-line growth, we achieved our full-year pro-forma adjusted EBITDA target of approximately $29 million. While our pro forma gross profit increased 27% year over year, our gross profit margin was lower than we expected; however, we are executing a plan to improve margins in 2019 through efficiencies in manufacturing, procurement, and distribution, as well as through new innovations.

Our success since the IPO is the result of our delivery against our core growth strategies, beginning with incremental sales of our brands at existing retailers. This organic growth led to MAV Beauty Brands entering the top ten hair care manufacturers in the U.S. FDM market and becoming the fastest-growing among the top ten brands.

We also continue to make meaningful progress with our core strategy to cross-sell the brands to existing retailers, which offers the most compelling evidence of the power of our platform. Cake Beauty launched nationally with two U.S. retailers in the second half of 2018 and Renpure has expanded into Canada.

MAV Beauty will continue significant expansion internationally as the core brand growth remains strong and we have invested in a global sales structure. In 2018, we significantly expanded our international footprint, entering 10 new markets, bringing the total international reach to 29 countries outside of North America at the end of the year. Today our products can be found in over 30 countries around the world, in over 100 major retailers and through more than 60,000 doors.

On top of these core growth strategies, we were pleased with the early results of the category expansion of Renpure and Cake Beauty, as both brands introduced new body wash and lotion offerings in recent quarters. These newly developed categories are expected to be an additional growth driver in the coming years.

Emboldened by the progress and lessons learned from our 2018 acquisitions, over time our vision is to acquire other high-growth, profitable iconic brands that – while they are valuable as stand-alone brands – can grow faster by partnering with MAV Beauty Brands. While there are certainly lessons learned from these first acquisitions, we have proven our ability to integrate other businesses, increase their brand distribution, and accelerate their product innovation.

In summary, it was a highly eventful and successful 2018 for the company and I want to thank the entire team for their efforts. I would also like to thank you, our shareholders, for your support and investment. We look forward to continuing to profitably scale the company to establish a truly iconic portfolio of brands. In doing so, we expect to create significant value for our shareholders over the long term.

Sincerely,

Marc Anthony Venere

Founder & Chief Executive Officer

Download PDFs

Click below to view key regulatory and informational documents